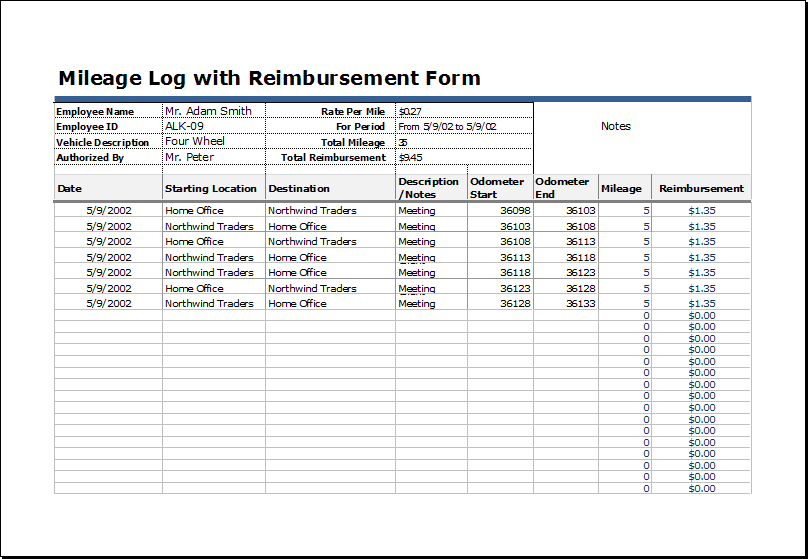

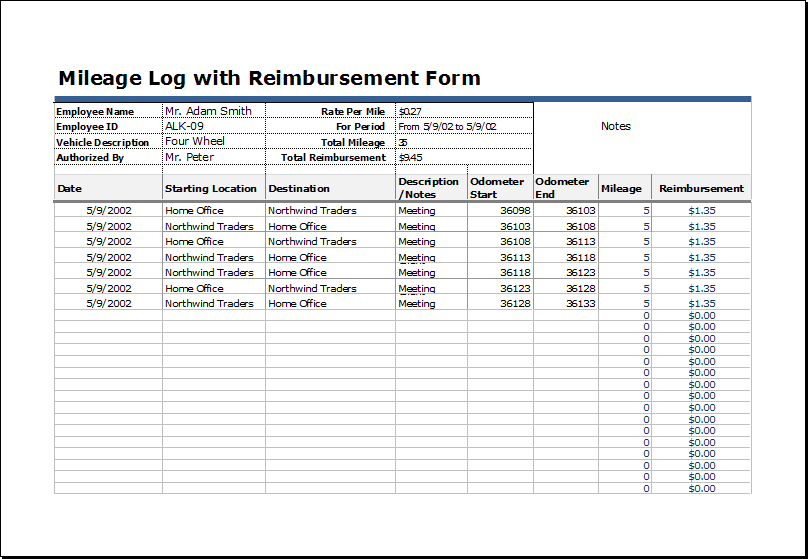

To calculate your deduction, multiply the number of business kilometres you travel in the car by the appropriate rate per kilometre for that income year. You can claim a maximum of 5,000 business kilometres per car. If the exempt rate is 66c/km (R), Bob’s employer would receive an exemption on the. 66 cents per kilometre for the 201718, 201616. Motorcycles will be charged at a rate of 43.5 cents per mile, while cycles will be charged at a rate of 37.5 cents. in total for work and is paid an allowance of 500 by his employer. Workers will be paid five cents per kilometre more on average beginning on 15 March 2022 and continuing through 30 June 2022 for mileage between 58.5 cents per km and 63.5 cents per km. a simple cents per kilometre based on your travel up to 5000kms per year (this rate makes an allowance for wear & tear) 2. This does not apply to situations where you reimburse an employee for toll or ferry charges or supplementary business insurance, if you determined the allowance without including these reimbursements The motor vehicle exempt rate to be used is the cents per km rate from the previous year (for example, the rate used in 2022/23 is the ATO 2021/22 rate).

You did not reimburse the employee for expenses related to the same use of the vehicle. The allowance is based only on the number of business kilometres driven in a year. Reimbursements based on the federal mileage rate aren't considered income, making. For 2020, the federal mileage rate is 0.575 cents per mile. You can deduct the difference between the 2022 rate of 0.63 per mile and the. The IRS sets a standard mileage reimbursement rate. In Canada, the CRA rate for 2021 is 59 cents per kilometre (for the first 5000 kilometres53¢ per mile after that). The CRA considers an allowance to be reasonable if all of the following conditions apply: For example: Your employer reimburses mileage at a rate of 30 cents per mile. Although these rates represent the maximum amount that you can deduct as business expenses, you can use them as a guideline to determine if the allowance paid to your employee is reasonable. The type of vehicle and the driving conditions are other factors used to determine whether an allowance is considered to be reasonable. The per-kilometre rates that the CRA usually considers reasonable are the amounts prescribed in section 7306 of the Income Tax Regulations. "Right now the doesn't come anywhere near meeting the cost, so our workers are paying to go to work," she said.If you pay your employee an allowance based on a per-kilometre rate that is considered reasonable, do not deduct CPP contributions, EI premiums, or income tax. The standard mileage rate that businesses use to pay tax-free reimbursements to employees who drive their own cars for business will be 58.5 cents per mile in 2022, up 2.5 cents from 2021, the IRS. Government Employees Union (BCGEU) says thousands of their members use their own personal vehicles as part of their job, including community health and social service workers. If your job requires you to drive your personal vehicle for work, your employer likely offers an incentive in return for the wear and tear youre putting on your car. The mileage rate has also affected employees in others sectors. The CRA did not respond to CBC's request for comment.

You did not reimburse the employee for expenses related to the same use of the vehicle. The allowance is based only on the number of business kilometres driven in a year. Reimbursements based on the federal mileage rate aren't considered income, making. For 2020, the federal mileage rate is 0.575 cents per mile. You can deduct the difference between the 2022 rate of 0.63 per mile and the. The IRS sets a standard mileage reimbursement rate. In Canada, the CRA rate for 2021 is 59 cents per kilometre (for the first 5000 kilometres53¢ per mile after that). The CRA considers an allowance to be reasonable if all of the following conditions apply: For example: Your employer reimburses mileage at a rate of 30 cents per mile. Although these rates represent the maximum amount that you can deduct as business expenses, you can use them as a guideline to determine if the allowance paid to your employee is reasonable. The type of vehicle and the driving conditions are other factors used to determine whether an allowance is considered to be reasonable. The per-kilometre rates that the CRA usually considers reasonable are the amounts prescribed in section 7306 of the Income Tax Regulations. "Right now the doesn't come anywhere near meeting the cost, so our workers are paying to go to work," she said.If you pay your employee an allowance based on a per-kilometre rate that is considered reasonable, do not deduct CPP contributions, EI premiums, or income tax. The standard mileage rate that businesses use to pay tax-free reimbursements to employees who drive their own cars for business will be 58.5 cents per mile in 2022, up 2.5 cents from 2021, the IRS. Government Employees Union (BCGEU) says thousands of their members use their own personal vehicles as part of their job, including community health and social service workers. If your job requires you to drive your personal vehicle for work, your employer likely offers an incentive in return for the wear and tear youre putting on your car. The mileage rate has also affected employees in others sectors. The CRA did not respond to CBC's request for comment.

The union is petitioning the CRA to temporarily raise mileage rates by at least 15 per cent until the average price of gas drops below $1.75 per litre. "Even if the companies did pay them more, then that vehicle allowance completely becomes taxable - even the stuff that is below the 61 cents," Jones said. Employers may choose to provide a different rate for workers, but if they do, those payments are considered taxable income by the government. Gas reimbursements made to employees at the standard mileage rate are not taxed.

gas prices surging when the province gets most of its gas from local refineries?

0 kommentar(er)

0 kommentar(er)